Written by Yanis Kharchafi

Written by Yanis KharchafiIn the event of a divorce, what will happen to my second pillar (LPP)?

The line-up:

Introduction

Having dealt with the risk of death and disability, we’ll now take a moment to explain another risk (less vital) but just as crucial in terms of the 2nd pillar: divorce.

When you propose to someone, you are well aware that you will have a close legal relationship once the union has been celebrated. You will have advantages in terms of donations and inheritance, you will also have better protection against risks, and you will have to choose a matrimonial property regime.

On the other hand, it is less well known that the 2nd pillar is also an important issue in a marriage. Throughout your career, you will work without really choosing how to contribute to your pension fund. Over time, these contributions will become important, even very important, and could even become the main source of household savings.

How will your 2nd pillar be divided after a divorce?

Once the divorce is under way, you’ll have to negotiate to separate out what will go to each of you, and believe me, that’s when you’ll realise that the 2nd pillar is far from trivial.

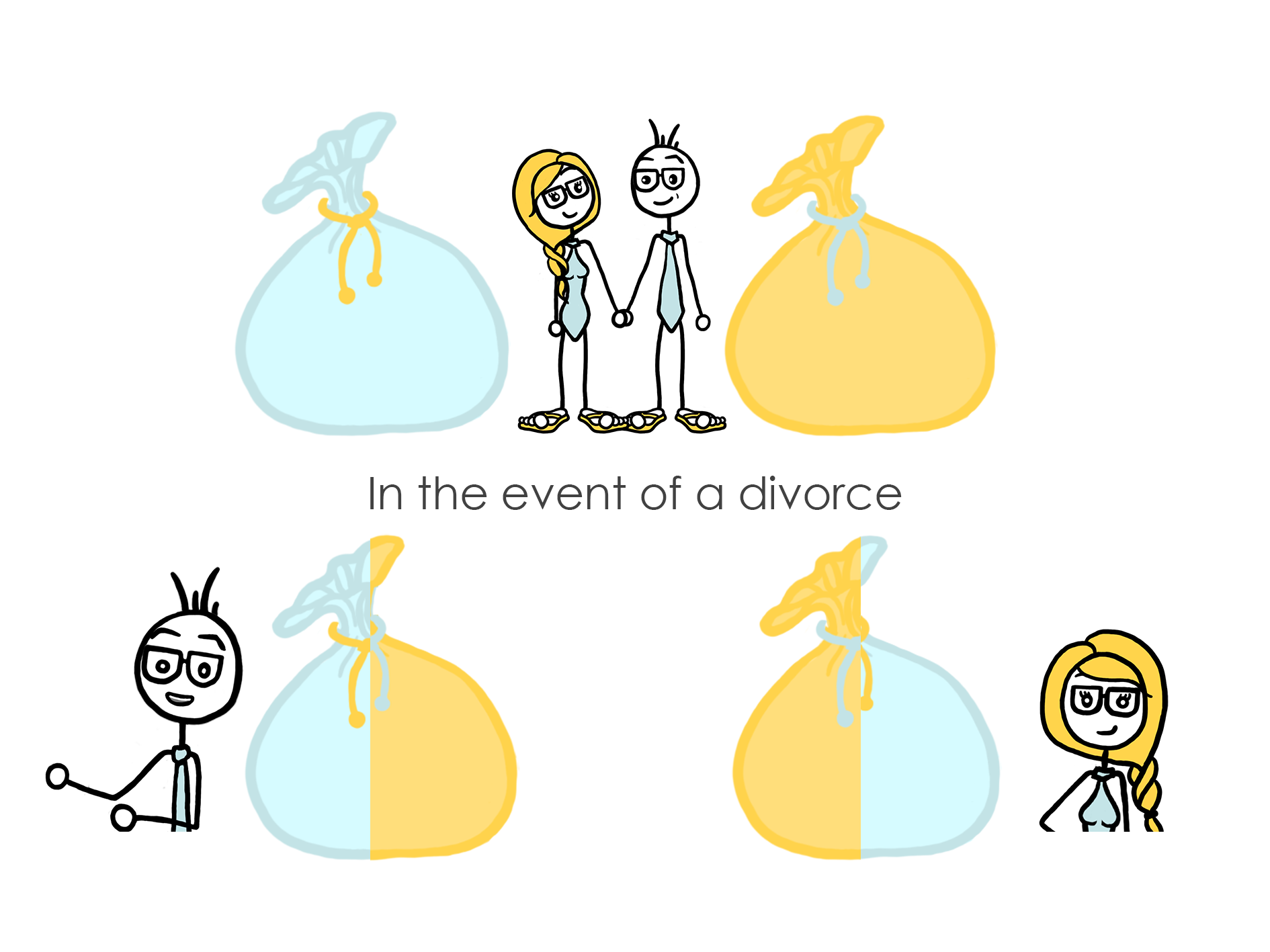

In order to avoid conflicts, the law is relatively clear on this subject in art. 122 of the Civil Code. In other words, regardless of your matrimonial property regime, you’ll have to split your assets (each one its own) in two and pay that half to your ex. Pretty harsh, isn’t it?

Is it possible to ask not to share your 2nd pillar after a divorce?

Despite this seemingly unambiguous article of the law, practice may not be so clear-cut. In practice, if the two ex-spouses seem to agree not to proceed with the division of the BVG assets and the judge considers that no party is prejudiced, then in certain cases it is possible to derogate from this law.

However, simply because you agree not to separate your vested benefits assets does not mean that this is the case. The judge will have the final say.

What should be done with the division of the 2nd pillar after a divorce?

If the division is declared and you have received part of your ex-spouse’s 2nd pillar pension, you can either :

Repatriating funds to your current pension fund

If your pension fund can receive funds from your ex-spouse, you should be able to collect everything from your current employer.

Opening a vested benefits account with a financial institution

If it is not possible to repatriate the funds or if you don’t have a pension fund, you will be obliged to open a vested benefits account to deposit the funds until you are in a position to request withdrawal of your 2nd pillar pension.

For those still wondering what a vested benefits account is, this article is for you: What is a vested benefits account?

Are BVG/LPP buy-backs also separated after a divorce?

Before answering this question, I invite you to familiarise yourself with the BVG/LPP buy-back process in order to determine whether you or your future ex-spouse made buy-backs during the years of your marriage. If this is the case, the purchases made during the marriage will also be separated unless you can prove that the funds used belong directly to you or that they come from an inheritance or a donation.

Is it possible to make buybacks after separating your 2nd pillar?

As we have seen, in most cases, a divorce involves a division of the 2nd pillar assets. This means that one of the ex-spouses may end up with a significantly reduced pension account, similar to the one they had several years ago.

But then, if you have lost a significant portion of your contributions, can you voluntarily reinvest to fill that gap?

The answer is yes! Buybacks made after a divorce are allowed, and they are also tax-deductible. This option not only helps strengthen your retirement coverage but also provides a tax benefit.

What happens to my 3rd pillar pension after a divorce?

Unlike the 2nd pillar, which in most cases will be split between the two ex-spouses, the 3rd pillar will be based on the matrimonial regime you have chosen.

How FBKConseils can help you?

At FBKConseils, we do not claim to be a matrimonial advisory firm. However, we are experts in professional pension planning and offer two solutions to meet your needs:

A free introduction meeting

For 20 minutes, we offer a free meeting to provide clear and precise answers to your most important questions about the 2nd pillar.

A personalized advisory meeting

For more specific needs, we offer a consultation tailored to your situation. The duration is flexible according to your needs. During this session, we:

- Answer your questions in detail;

- Conduct the necessary simulations to clarify your choices;

- Assist you with the administrative steps related to your projects.

Whether you want to optimize your 2nd pillar, plan your retirement, or manage a complex situation, we are here to guide you.